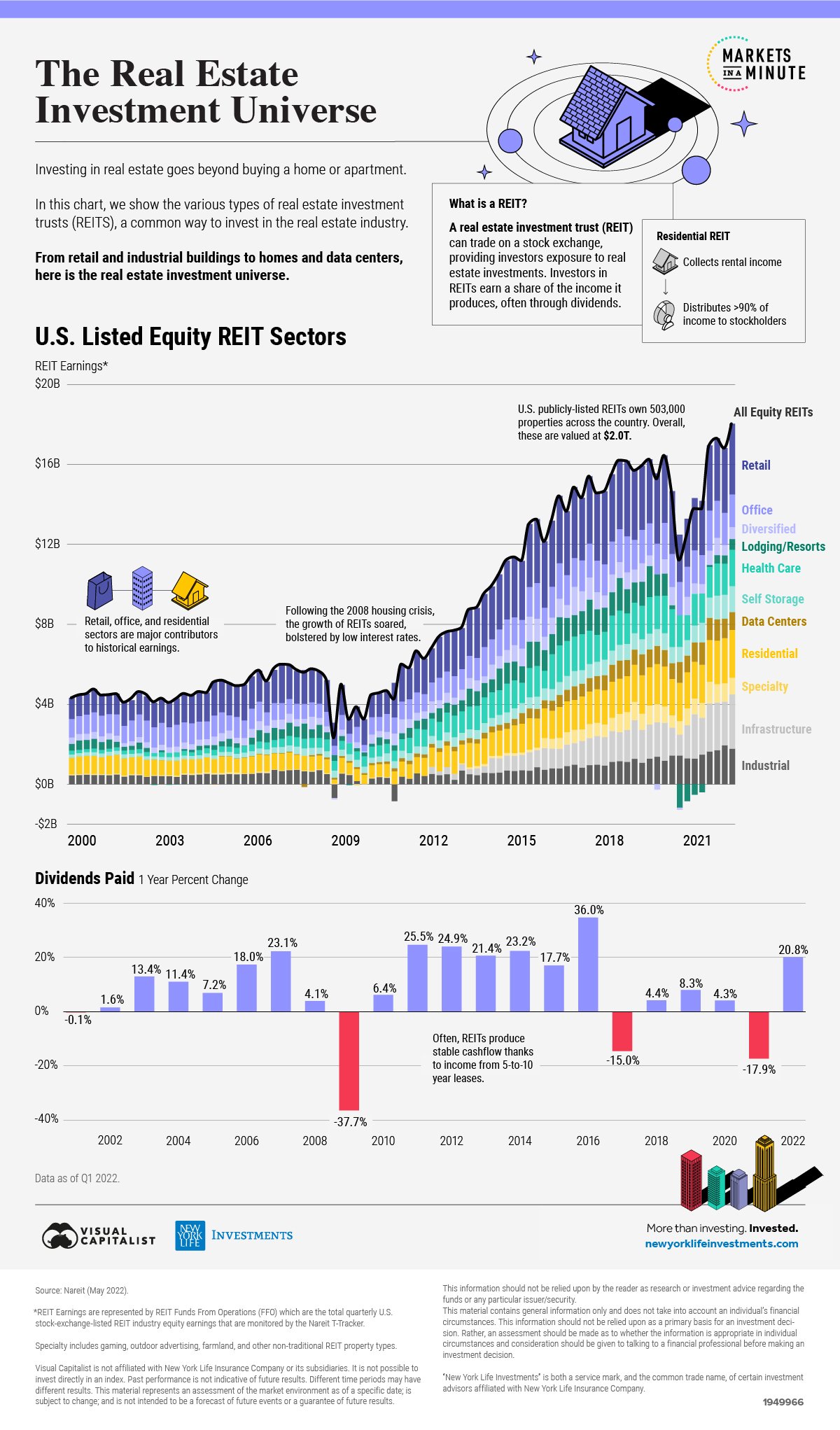

Investment Strategy Overview

Successful real estate investing in West Virginia requires a strategic approach tailored to the state's unique market conditions. With its affordable entry points, steady growth, and diverse regional markets, West Virginia offers multiple pathways to investment success.

This guide outlines proven business models and investment strategies specifically designed for West Virginia's real estate landscape, based on current market data and expert insights.

House Flipping in West Virginia

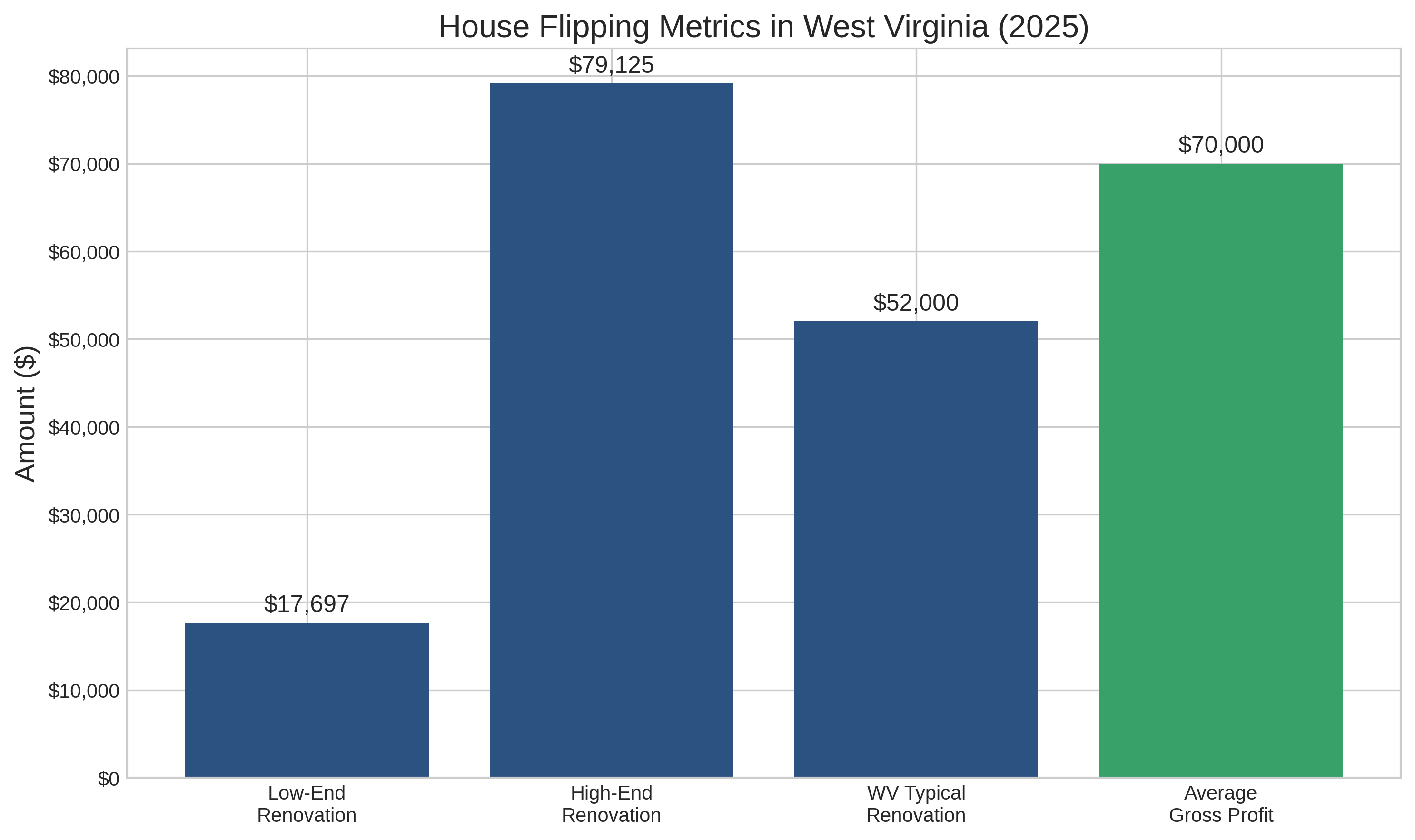

Renovation Costs (2025)

- Average Renovation Range: $17,697 to $79,125

- West Virginia-Specific Costs: Up to $52,000 for typical renovations

- Upfront Cost Components:

- Purchase price

- Renovation expenses

- Holding costs during renovation period

ROI Expectations

- Average Gross Profit: $70,000 per flip (Q2 2024)

- Market Advantage: West Virginia offers a cost-effective flipping environment due to relatively low property prices

- Profit Potential: Higher potential ROI compared to states with more expensive real estate markets

Timeline Considerations

- Renovation Period: Factor in holding costs during this time

- Market Timing: Summer months typically offer better selling opportunities

- Project Planning: Allow buffer time for unexpected renovation challenges

Common Renovation Strategies

Value-Adding Renovations

1. Kitchen Updates

- Focus on modern appliances and fixtures

- Consider cost-effective cabinet refacing rather than full replacement when possible

2. Bathroom Renovations

- Updated fixtures and lighting

- Modern tile and flooring options

3. Flooring Improvements

- Replace worn carpeting with hardwood or quality laminate

- Refinish existing hardwood floors when possible

4. Curb Appeal Enhancements

- Landscaping improvements

- Exterior painting

- Front door and entryway updates

Renovations to Avoid

- Adding swimming pools (cost exceeds value added)

- Overly customized features

- High-end upgrades in mid-range neighborhoods

Investment Approaches

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties and holding them for long-term appreciation and rental income. This approach is particularly effective in West Virginia's stable market.

- Target Areas: University towns like Morgantown or growing areas like Berkeley County

- Rental Potential: 27.1% of properties in West Virginia are tenant-occupied

- Long-term Appreciation: Focus on areas with economic growth indicators

Potential ROI

8-12% annually (including cash flow and appreciation)

Timeline

5+ years for optimal returns

BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat)

The BRRRR method is a systematic approach to building a rental property portfolio that's particularly effective in West Virginia's affordable market.

- Application in WV: Effective due to affordable property values

- Focus Areas: Emerging neighborhoods in Charleston, Huntington, and Parkersburg

- Financing Considerations: Local lender relationships are crucial

Process

- Buy undervalued property

- Rehab to increase value

- Rent to generate cash flow

- Refinance to recover capital

- Repeat with recovered funds

Land Investment

Land investment in West Virginia can be a strategic long-term play, particularly in areas with tourism potential or development prospects.

- Opportunity Areas: Scenic locations with tourism potential

- Considerations: Zoning regulations and development potential

- Long-term Strategy: Hold for future development or resale

Best Land Types

- Recreational land near outdoor attractions

- Development land near growing cities

- Agricultural land with multiple use potential

Market-Specific Investment Considerations

Geographic Factors

- Topography: Mountainous terrain can affect construction costs and property accessibility

- Flood Plains: Research flood zone designations before purchasing

- Infrastructure Access: Verify utility connections and road access

Local Regulations

- Zoning Laws: Vary significantly between municipalities

- Building Codes: May require specific renovations to meet current standards

- Permit Requirements: Research local permitting processes before beginning renovations

Economic Considerations

- Employment Trends: Focus on areas with stable or growing employment

- Industry Diversification: Areas moving beyond traditional industries like coal mining

- Tourism Impact: Consider investment in areas with growing tourism economies

Best Practices for West Virginia Investors

Due Diligence

- Thorough property inspections

- Title searches and property history research

- Local market analysis

Networking

- Connect with local real estate investment groups

- Build relationships with contractors familiar with West Virginia properties

- Develop connections with local real estate agents

Financial Planning

- Calculate all potential costs, including renovation, holding, and marketing expenses

- Budget for unexpected renovation challenges

- Maintain cash reserves for investment opportunities

Exit Strategy Planning

- Develop multiple potential exit strategies for each investment

- Understand local market cycles for optimal selling timing

- Consider lease options in slower-selling markets

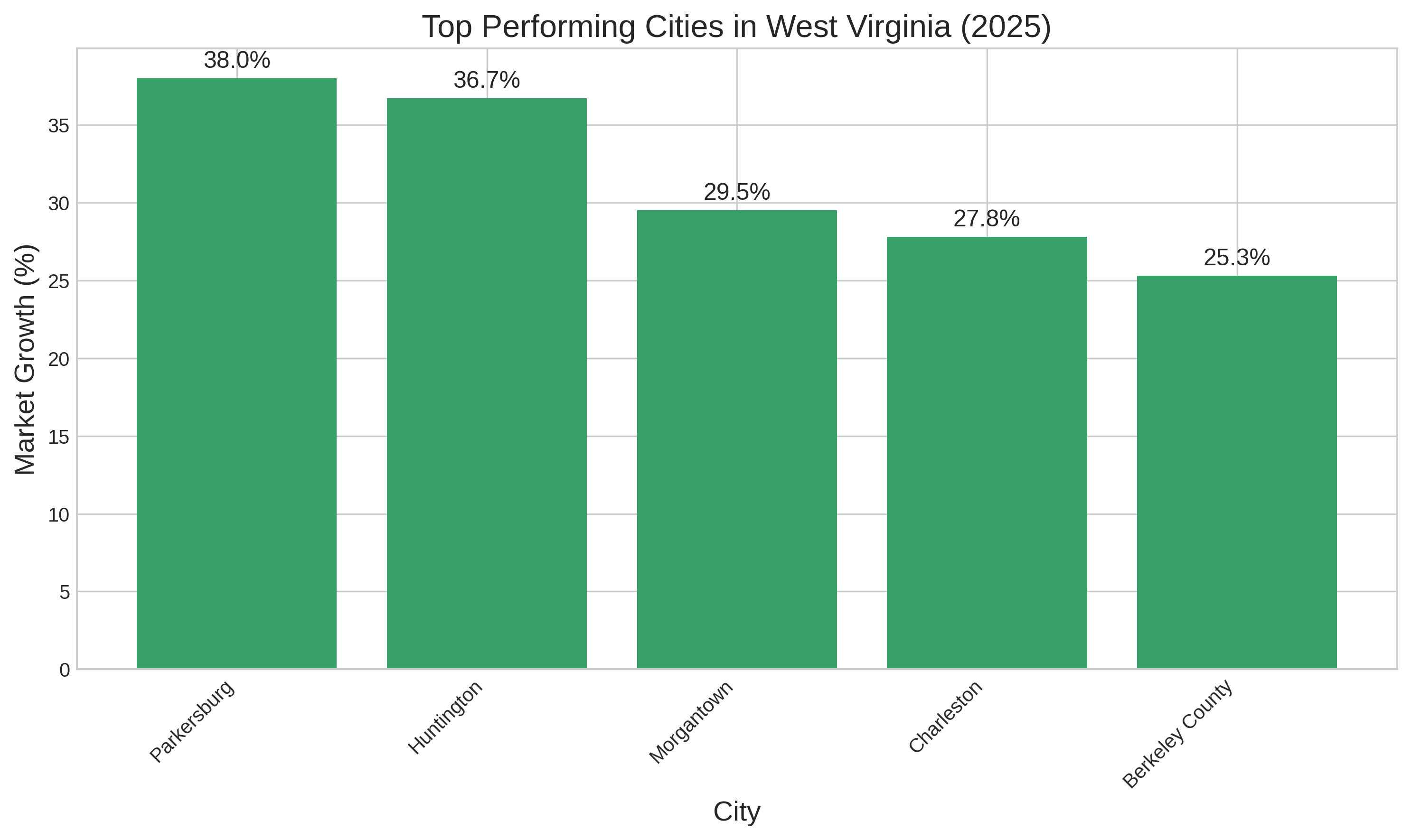

Regional Investment Strategies

West Virginia's diverse regions require tailored investment approaches. Here are specific strategies for the state's top investment cities:

Charleston Strategy

- Focus Areas: Downtown revitalization zones, East End, South Hills

- Property Types: Single-family homes, small multi-family properties

- Target Market: Government employees, healthcare professionals

- Strategy: Long-term buy-and-hold with steady appreciation potential

Morgantown Strategy

- Focus Areas: Properties near West Virginia University, Downtown

- Property Types: Student housing, multi-family properties

- Target Market: Students, faculty, healthcare workers

- Strategy: Student rental properties with strong cash flow potential

Huntington Strategy

- Focus Areas: Areas near Marshall University, Ritter Park

- Property Types: Single-family homes, historic properties

- Target Market: Students, young professionals

- Strategy: Value-add renovations and student housing

Parkersburg Strategy

- Focus Areas: Downtown, residential neighborhoods

- Property Types: Single-family homes, small commercial properties

- Target Market: Working families, professionals

- Strategy: Fix-and-flip with focus on affordable renovations

Understanding Tax Implications

A successful investment strategy must account for West Virginia's unique tax environment. With one of the lowest property tax rates in the nation at 0.55%, investors can benefit from reduced carrying costs.

Learn more about how to optimize your tax position as a West Virginia real estate investor.

Explore Tax Information