Tax Advantages in West Virginia

West Virginia offers real estate investors significant tax advantages, particularly with its low property tax rates. Understanding these tax benefits is essential for maximizing investment returns and developing effective long-term strategies.

This guide provides comprehensive information on West Virginia's tax environment for real estate investors, including property taxes, income taxes, deductions, and strategic tax planning considerations.

Property Tax

Property Tax Overview

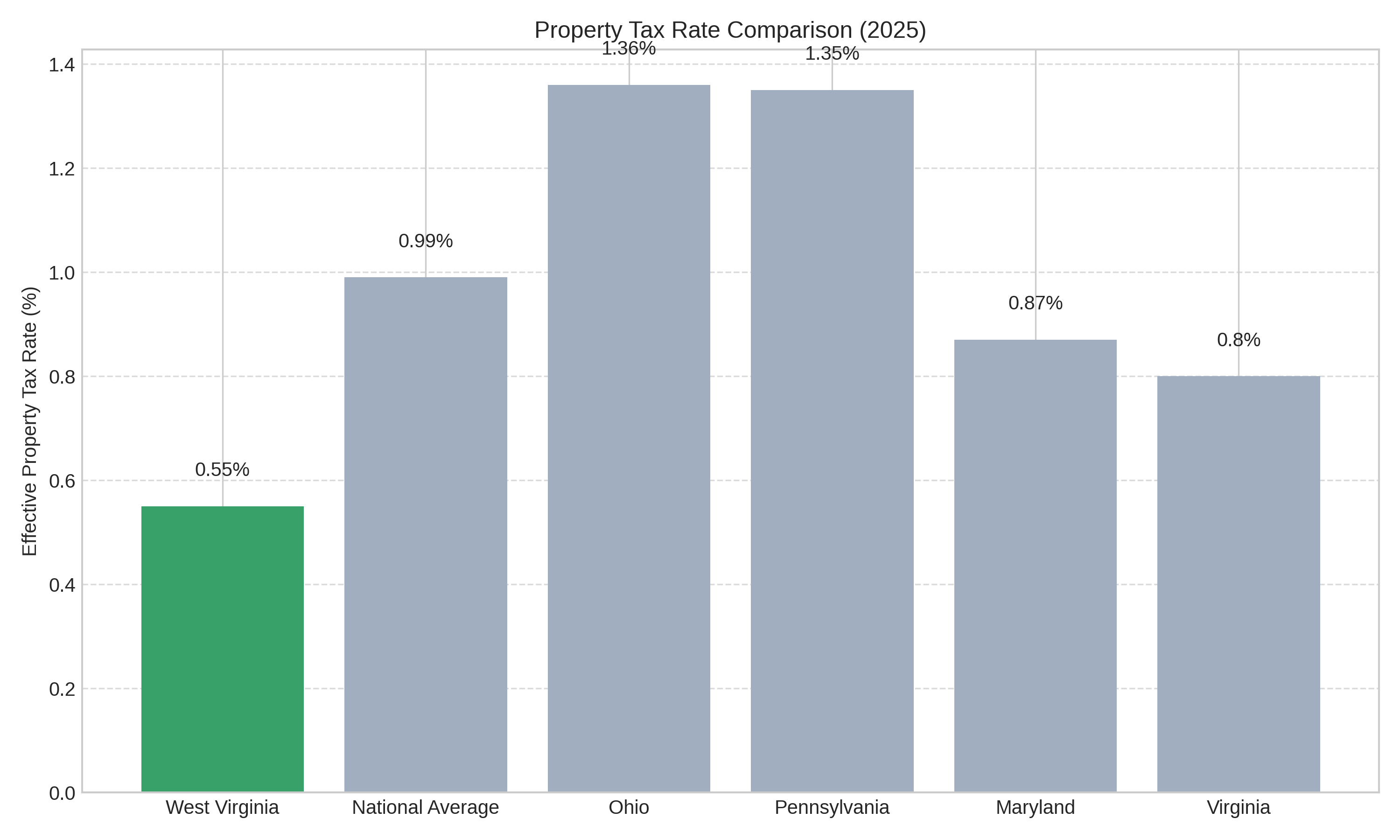

West Virginia boasts one of the lowest property tax rates in the United States, creating a favorable environment for real estate investors. The low carrying costs can significantly improve cash flow for rental properties and reduce holding costs for development projects.

Key Property Tax Facts:

- Average effective property tax rate: 0.55% (compared to national average of 0.99%)

- Ranked as the 9th lowest state property tax rate nationally

- Property taxes are composed of multiple levels: state, county, schools, and municipal

- Tax rates vary by location within the state

Property Tax Rate Components:

| Component | Rate Range |

|---|---|

| State | 0.25 to 1.00 |

| County | 14.30 to 57.20 |

| Schools | 22.95 to 91.80 |

| Municipal | 12.50 to 50.00 |

Property Tax Calculation

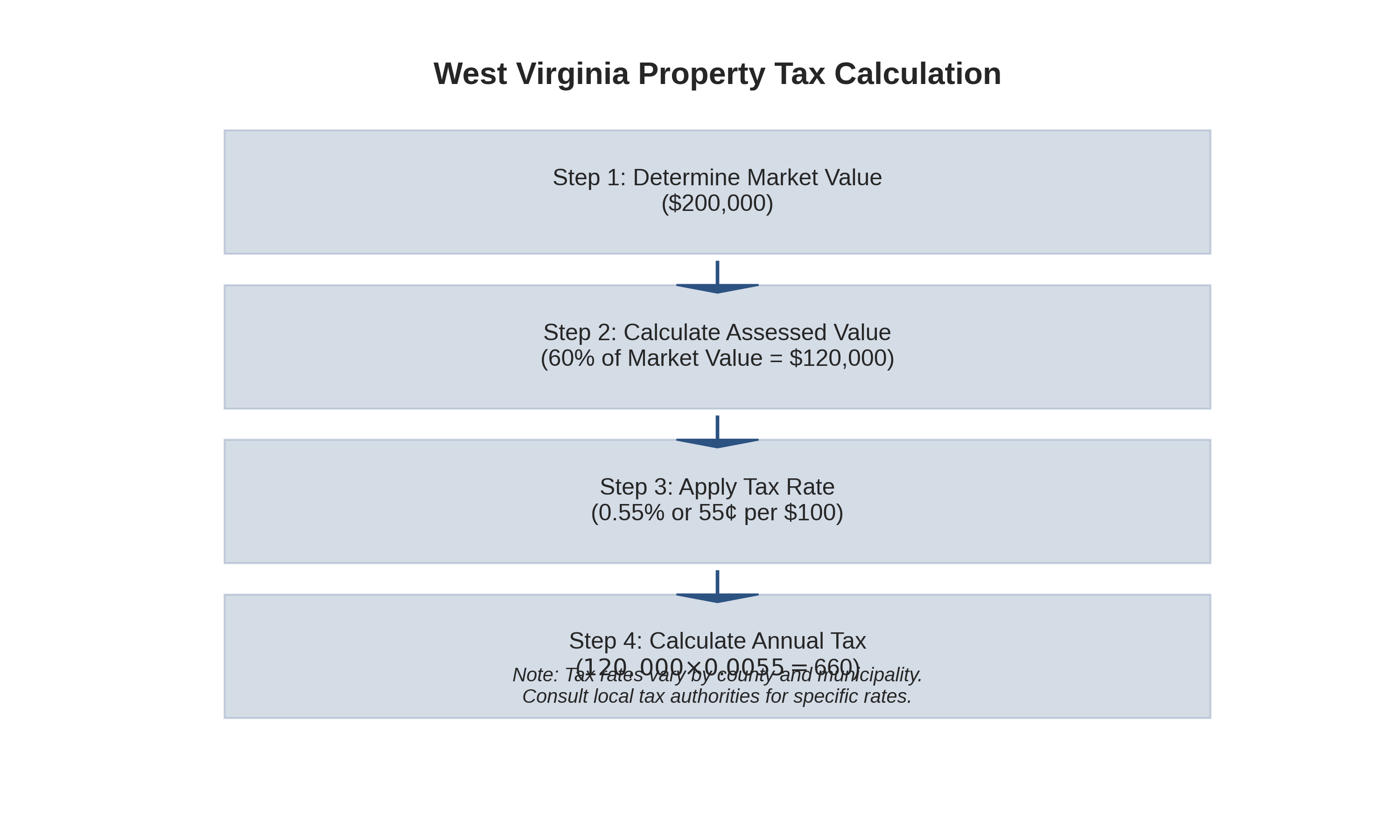

Understanding how property taxes are calculated in West Virginia can help investors accurately project expenses and cash flow.

Assessment Process:

- Properties are assessed at 60% of market value

- The assessed value is multiplied by the applicable tax rate

- Tax rates are expressed in cents per $100 of assessed value

Example Calculation:

- Property Market Value: $200,000

- Assessed Value (60%): $120,000

- Tax Rate: 0.55% (or 55 cents per $100)

- Annual Property Tax: $660

Strategic Considerations:

- Property taxes vary significantly by county and municipality

- Research specific local rates before investing

- Consider the impact of potential reassessments on future tax liability

- Budget for potential increases in tax rates over time

West Virginia Tax Timeline

Important Tax Dates for Real Estate Investors

Understanding the tax calendar is crucial for proper planning and compliance. Here are the key dates real estate investors in West Virginia should mark on their calendars:

First Half of Tax Year:

- July 1: New tax year begins; properties are assessed to the owner of record on this date

- July 15: Tax bills are typically mailed by the Sheriff's office

- September 1: First property tax installment due (2.5% discount available for early payment)

- October 1: First installment becomes delinquent if unpaid

- December 1: Last day for eligible homeowners to apply for homestead exemption

Second Half of Tax Year:

- March 1: Second property tax installment due

- April 1: Second installment becomes delinquent if unpaid

- April 15: Federal and state income tax returns due

- May-June: Tax lien sales typically occur for delinquent properties

Note: Specific dates may vary by county. Always verify deadlines with your local tax authority.

Income Tax Considerations

State Income Tax

West Virginia taxes real estate investment income as part of its state income tax system. Understanding these rates is essential for accurate profit projections.

Income Tax Rates (2025):

- State income tax rates range from 2.2% to 4.82%

- This represents a reduction from the previous range of 2.36% to 5.12%

- Capital gains are taxed as ordinary income using the same state income tax rates

- Recent tax reduction initiatives have lowered rates by approximately 21.25% since 2023

Income Tax Planning:

- Consider forming appropriate business entities (LLC, S-Corp) for potential tax advantages

- Track all deductible expenses related to your real estate investments

- Consult with a tax professional familiar with West Virginia tax law

- Stay informed about ongoing tax reduction initiatives in the state

- Future rate reductions will be assessed in August 2025 for potential implementation in January 2027

1031 Exchange Opportunities

Section 1031 exchanges allow real estate investors to defer capital gains taxes when selling investment properties and reinvesting in like-kind properties. This strategy is particularly valuable in West Virginia's growing market.

Key Benefits:

- Defer federal and state capital gains taxes

- Without a 1031 Exchange, combined tax rates could exceed 30%

- Preserve investment capital for property acquisition rather than tax payments

- Build wealth through compounding deferred taxes

1031 Exchange Requirements:

- Properties must be held for investment or business use

- Replacement property must be identified within 45 days

- Closing must occur within 180 days

- Qualified intermediary must handle funds

- Replacement property value must equal or exceed sold property value

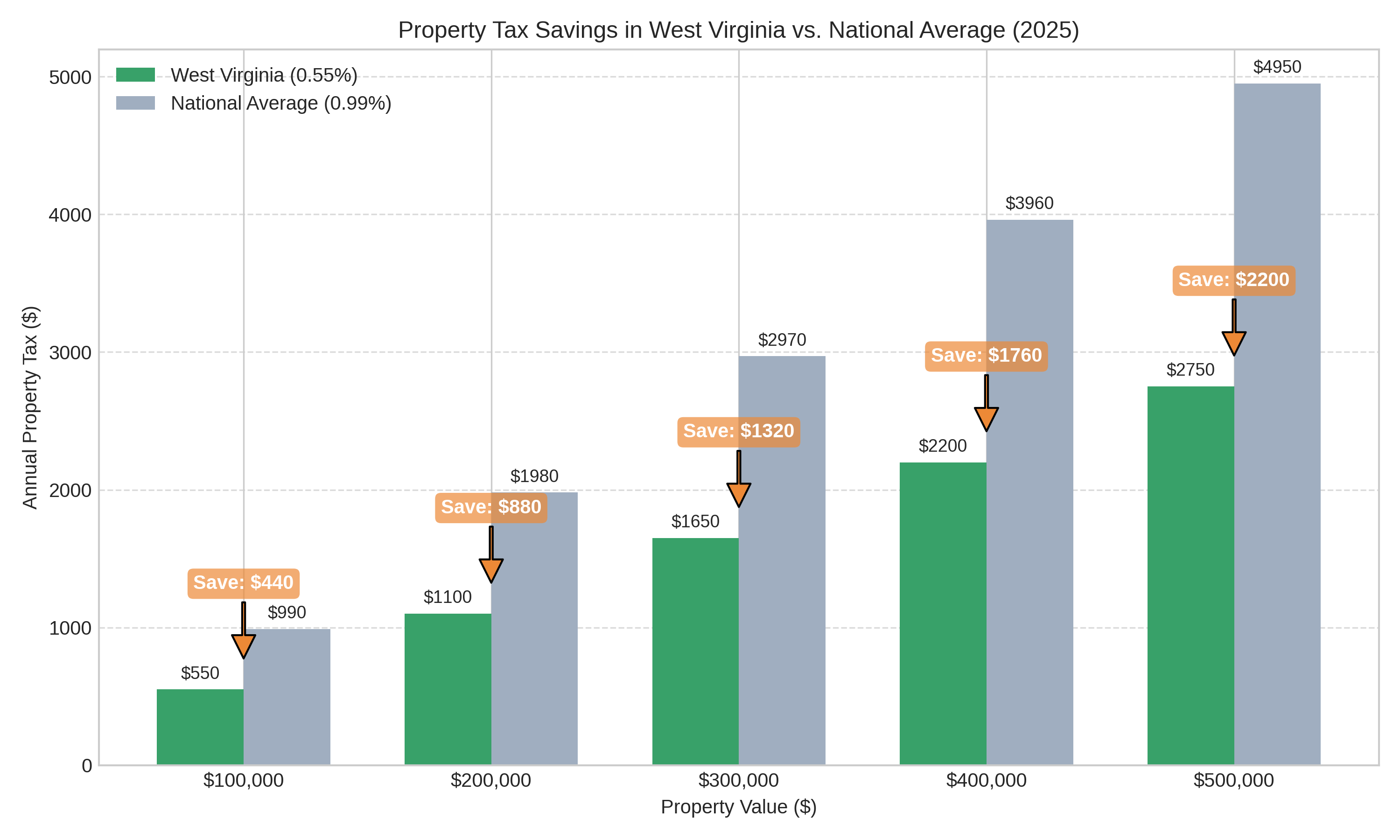

Tax Savings Calculator

Estimate Your Property Tax Savings in West Virginia

West Virginia's low property tax rate can result in significant savings compared to the national average. Use this calculator to estimate your potential savings.

Note: This calculator provides estimates only. Actual tax amounts may vary based on specific location, assessment practices, and applicable exemptions. Consult with a tax professional for precise calculations.

Property Tax Exemptions

Available Exemptions for West Virginia Property Owners

Homestead Exemption

- Current exemption: $20,000 off assessed value

- Eligibility: Property owners who are 65 or older or permanently disabled

- Must be owner-occupied primary residence

- Application deadline: December 1st

- 2025 Update: Proposed legislation may increase the exemption to $40,000 over four years

Other Potential Exemptions

- Farm Use Valuation: Agricultural properties may qualify for reduced valuation

- Nonprofit Exemptions: Properties owned by qualifying nonprofit organizations

- Government Property: Federal, state, and local government properties

- Religious and Educational: Properties used for religious or educational purposes

Legislative Update: Multiple bills (including SB724 and HB3058) are currently under consideration to increase the homestead exemption. Investors should monitor these developments, as they may impact property tax calculations for eligible properties.

Additional Tax Considerations

Transfer Taxes

When buying or selling real estate in West Virginia, investors should be aware of transfer taxes that apply to property transactions.

- West Virginia charges $1.10 per $500 of property value (approximately 0.22%)

- An additional $20 fee is assessed for transferring real estate

- Beginning July 1, 2024, counties will retain an additional 35% of the State Property Transfer Tax

- Some transfers may be exempt from this tax

- Budget for these costs when calculating transaction expenses

Tax Liens and Foreclosures

West Virginia's tax lien process creates both risks for property owners and opportunities for investors.

- Tax liens are sold to the highest bidder at public auction

- Property owners have an 18-month redemption period to reclaim their property

- If not redeemed, the tax lien purchaser may request a deed to the property

- The sheriff may suspend a tax lien sale if the property has been previously transferred by deed or if no delinquent taxes are actually owed

- Investors should thoroughly research properties before purchasing tax liens

Estate and Inheritance Tax

For long-term investment planning and wealth transfer strategies, investors should note:

- West Virginia does not have an estate tax

- West Virginia does not have an inheritance tax

- This creates favorable conditions for generational wealth transfer through real estate

- Federal estate tax may still apply to large estates

- Proposed legislative change (HJR15) suggests property taxes might end when a mortgage is paid off, unless the property is abandoned for more than four years

Tax Deductions for Real Estate Investors

Property-Related Deductions

- Mortgage Interest: Interest paid on loans for investment properties

- Property Taxes: Annual property tax payments

- Insurance Premiums: Property and liability insurance costs

- Depreciation: Systematic write-off of property value over 27.5 years (residential) or 39 years (commercial)

- Repairs and Maintenance: Costs to keep property in good working condition

- Utilities: Any utilities paid by the property owner

Business-Related Deductions

- Professional Services: Legal, accounting, and property management fees

- Travel Expenses: Costs related to property management and maintenance visits

- Home Office: Portion of home used exclusively for real estate business

- Education: Real estate investment courses and materials

- Marketing: Advertising costs for properties

- Software and Subscriptions: Tools used for property management

Common Tax Mistakes to Avoid

Tax Pitfalls for West Virginia Real Estate Investors

Depreciation and Valuation Errors

- Failing to properly account for property depreciation

- Not correctly allocating value between building and land

- Misunderstanding the discrepancy between cash received and taxable gain

Deduction Mistakes

- Overlooking business and real estate expense deductions

- Incorrectly tracking or failing to take available deductions

- Improperly deducting monthly escrow payments

- Neglecting home office deduction opportunities

Business Structure Issues

- Creating a legal corporation but not utilizing it effectively

- Misunderstanding the necessity of an LLC for tax purposes

- Choosing the wrong tax structure for real estate investments

Compliance and Documentation

- Not maintaining accurate financial records

- Failing to track expenses and income meticulously

- Not understanding specific West Virginia property tax regulations

- Missing important tax deadlines and filing requirements

Pro Tip: Consult with a tax professional who specializes in real estate investments and is familiar with West Virginia's specific tax laws. The cost of professional tax advice is typically far less than the potential cost of tax mistakes.

Opportunity Zones

West Virginia Opportunity Zone Tax Benefits

Opportunity Zones offer significant tax advantages for real estate investors in designated areas of West Virginia.

Key Tax Benefits

- Income Tax Exemption: New businesses created in West Virginia Opportunity Zones are exempt from corporate and personal income tax for 10 years

- Capital Gains Deferral: Investors can defer tax on prior eligible gains invested in a Qualified Opportunity Fund (QOF)

- Partial Forgiveness: Long-term investments may qualify for partial forgiveness of deferred capital gains

- Appreciation Exclusion: Investments held for 10+ years may qualify for exclusion of tax on appreciation

Opportunity Zone Coverage

- West Virginia has 55 designated Opportunity Zones

- Zones are typically located in low-income communities

- Designed to stimulate economic development and attract investment

- Investments must be made through a Qualified Opportunity Fund

- Applies to businesses formed between January 1, 2019, and January 1, 2024, within designated opportunity zones

Important: Opportunity Zone investments require careful planning and compliance with specific IRS guidelines. Consult with a tax professional experienced in Opportunity Zone investments before proceeding.

Tax Planning Strategies

Strategic Tax Planning for West Virginia Real Estate Investors

Entity Structure Optimization

- Consider LLC formation for liability protection and pass-through taxation

- Evaluate S-Corporation status for potential self-employment tax savings

- Assess partnership structures for multi-investor projects

Cost Segregation

- Accelerate depreciation deductions through cost segregation studies

- Identify components that qualify for shorter depreciation schedules

- Improve cash flow through increased early-year deductions

Opportunity Zones

- Invest in designated Opportunity Zones throughout West Virginia

- Defer and potentially reduce capital gains taxes

- Eliminate taxes on appreciation if held for 10+ years

Real Estate Professional Status

- If you qualify as a real estate professional, rental losses may offset other income

- Requires 750+ hours working in real estate activities

- More than half of your working time must be in real estate

Ready to Implement Your Investment Plan?

Now that you understand the tax implications of real estate investing in West Virginia, use our interactive checklist to track your progress through the investment process.

View Investor Checklist