Current Market Overview (2025)

Housing Market Metrics

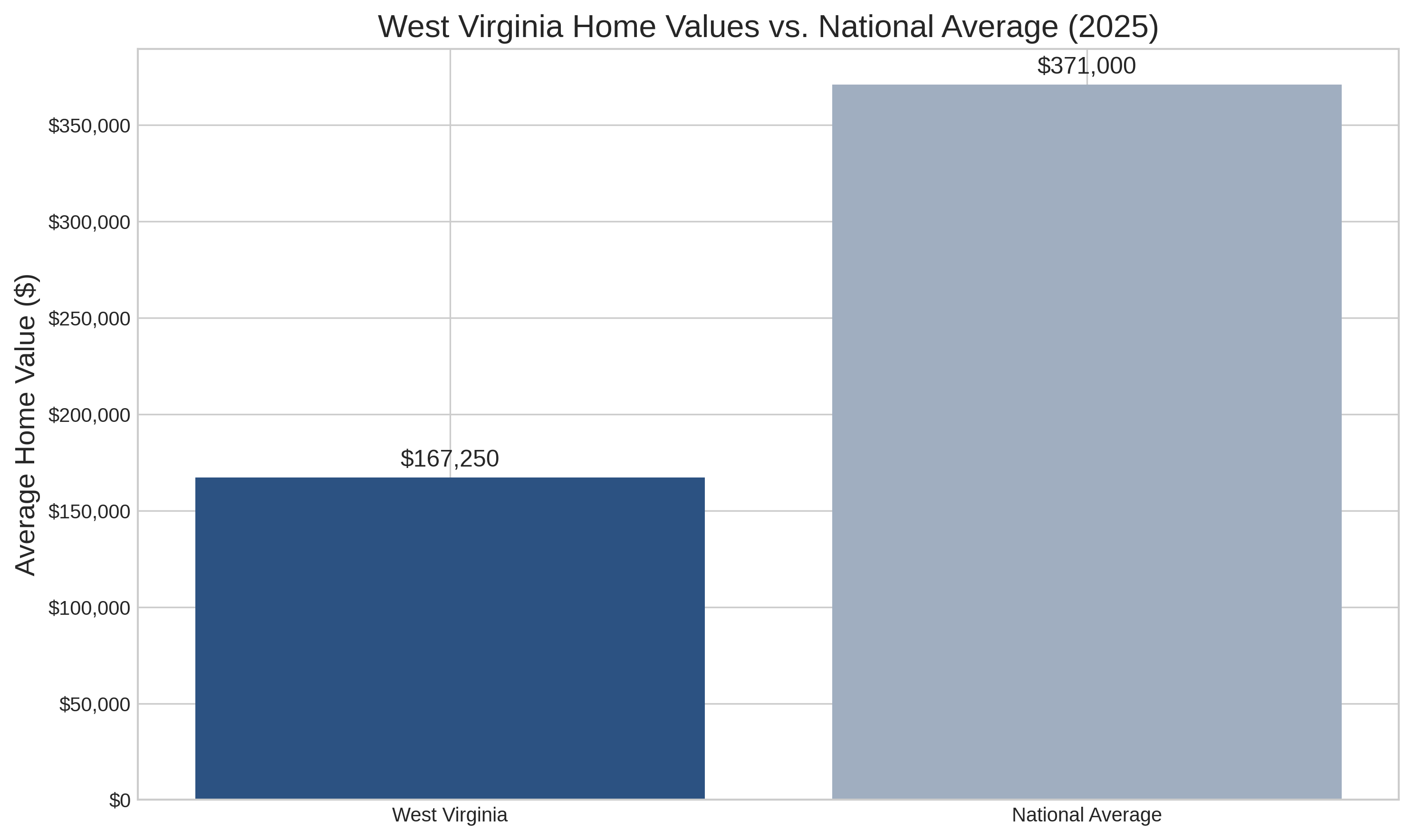

- Average Home Value: $167,250 (up 3.5% year-over-year)

- Median Listing Price: $263,881 (41.1% lower than national average)

- Median Sale Price: $248,300 (40.8% lower than national average)

- Median Single-Family Home Price: $250,000

- Home Price Increase: 9.4% year-over-year (as of September 2024)

- Days on Market: Approximately 59 days

- Market Competitiveness: Ranked as the 14th least competitive housing market in 2025

Affordability Metrics

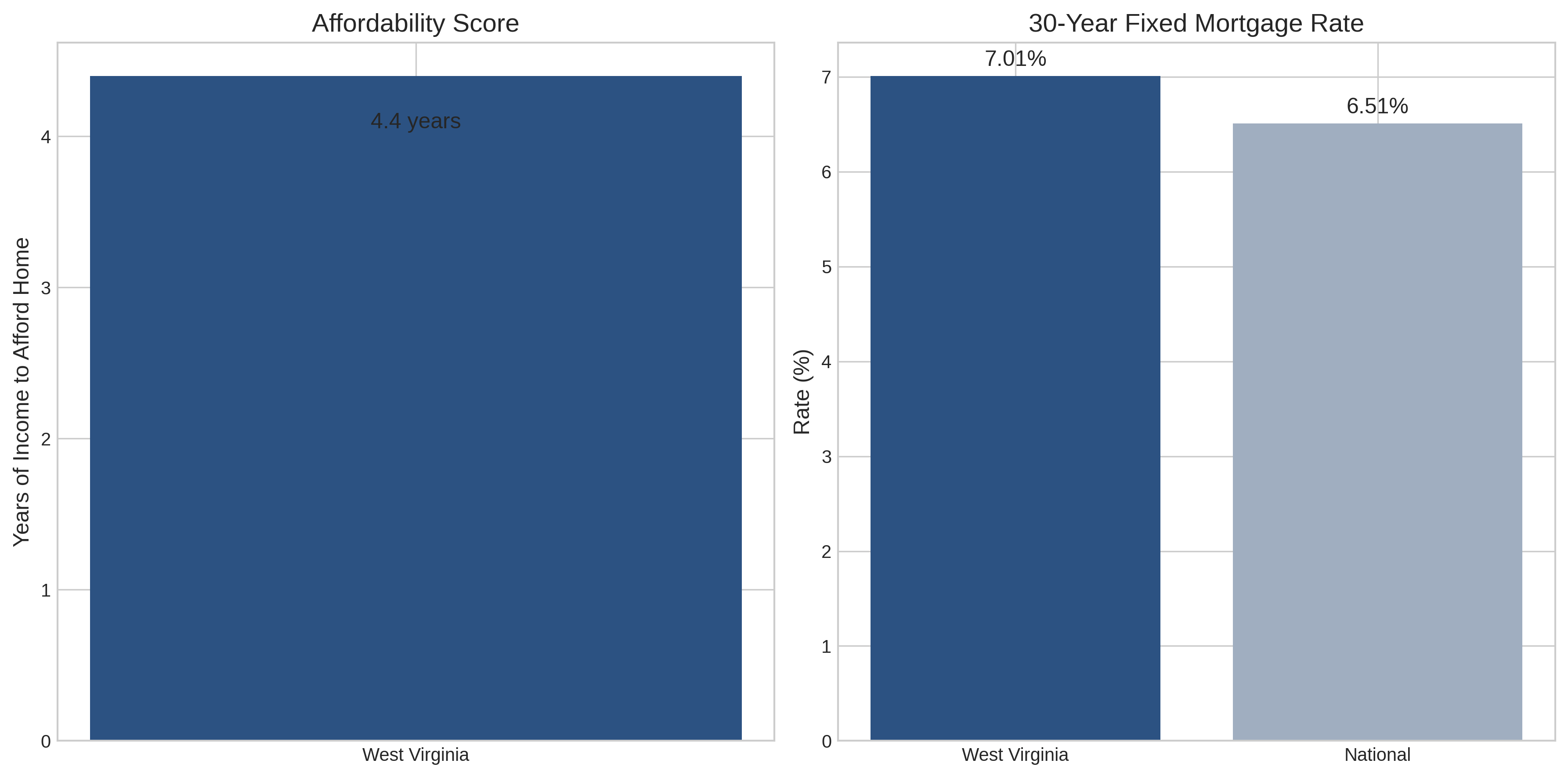

- Affordability Score: 4.4 (meaning it takes 4.4 years of median income to afford a median-priced home)

- Median Household Income: $55,948

- Mortgage Rate: 30-Year Fixed Rate at 7.01% (0.5% higher than national average)

Regional Hotspots for Investment

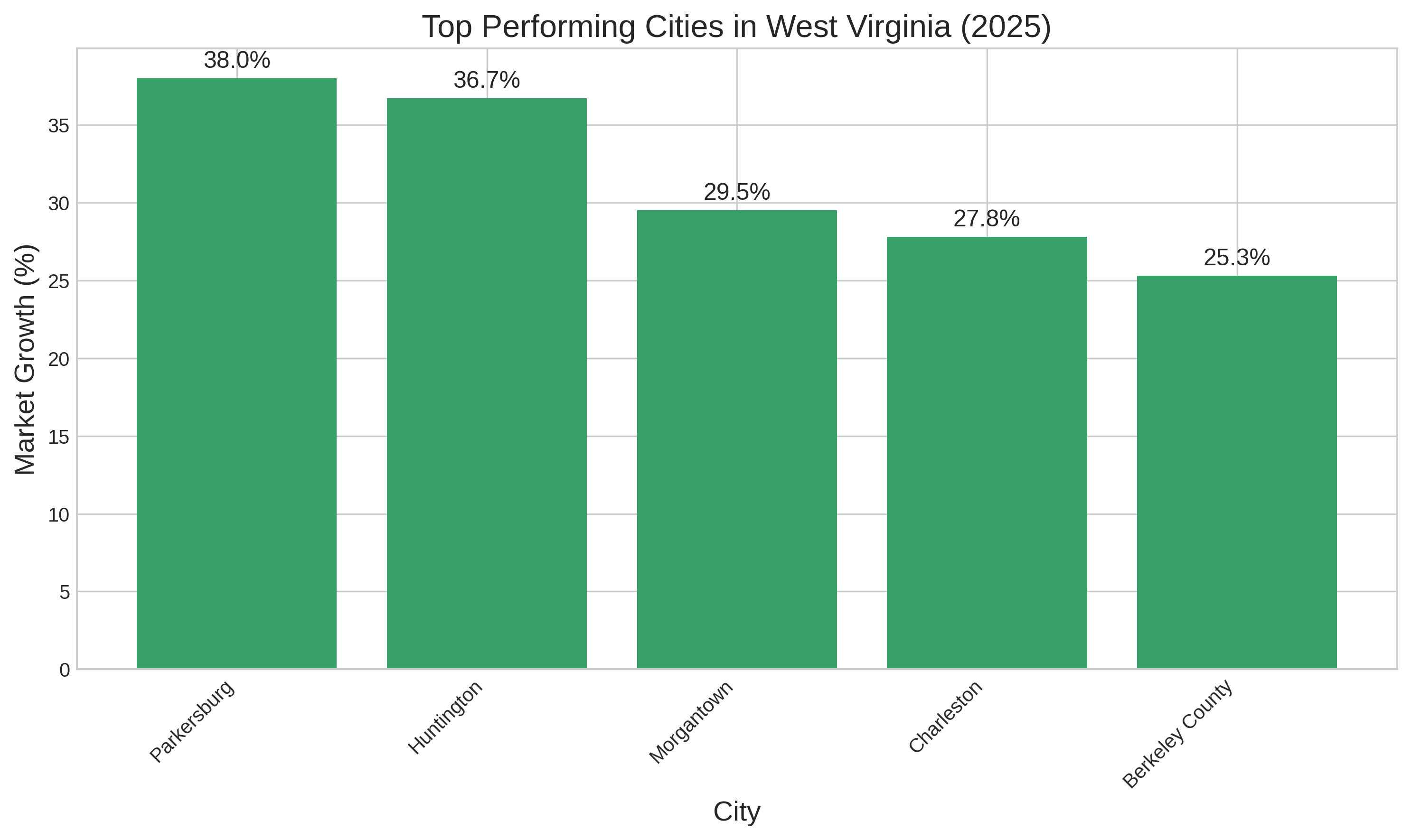

Top Performing Cities

-

Parkersburg

- Highest market growth at 38.0%

- Strong potential for continued appreciation

-

Huntington

- Strong market with 36.7% growth

- Consistent demand for housing

-

Morgantown

- Stable housing market with university presence

- Attractive for long-term investments and rental properties

-

Charleston

- State capital with diverse economic base

- Steady appreciation potential

Emerging Investment Areas

- Berkeley County: Close proximity to Washington D.C. metropolitan area

- Culloden: Growing suburban area

- Poca: Developing market with potential

- Bridgeport: Strong local economy

- Bethlehem: Emerging investment opportunity

Top Cities for Real Estate Investment

Charleston

As the state capital, Charleston provides a stable economic environment with government employment opportunities and a diverse economic base. The city offers strong potential for both residential and commercial properties.

- Key Advantages: State capital, government employment hub, cultural center

- Investment Potential: Strong for both residential and commercial properties

- Market Growth: 27.8%

Morgantown

Morgantown offers strong investment potential with consistent rental demand driven by West Virginia University. The expanding job market and university presence create a stable environment for real estate investors.

- Key Advantages: Thriving university presence, consistent rental demand, expanding job market

- Investment Potential: Excellent for rental properties, particularly near campus

- Market Growth: 29.5%

Huntington

Huntington consistently appears in top investment city lists with promising real estate investment opportunities. The city offers a good balance of affordability and growth potential.

- Key Advantages: Marshall University presence, healthcare sector, affordability

- Investment Potential: Good for residential properties and student housing

- Market Growth: 36.7%

Parkersburg

Parkersburg leads West Virginia cities in market growth and offers excellent investment opportunities. Its location on the Ohio River and relatively low property prices make it attractive for investors.

- Key Advantages: Ohio River location, manufacturing base, affordability

- Investment Potential: Good for long-term investments and rental properties

- Market Growth: 38.0%

Demographic Trends Affecting the Market

Population Dynamics

- West Virginia is experiencing relatively low population demand for real estate

- Less competitive market compared to coastal or metropolitan areas

- Lower housing demand due to demographic challenges

Economic Sector Influences

- Key economic sectors affecting real estate:

- Mining

- Healthcare and Social Assistance

- Real Estate and Rental/Leasing

Seasonal Market Patterns

- Summer months (June-August) show increased activity

- New listings typically increase by 30-35% compared to winter months

Market Insight

West Virginia's demographic trends create a unique investment landscape. While population growth is modest, this translates to less competition for properties and more affordable entry points for investors. The seasonal patterns provide strategic timing opportunities for both buying and selling properties.

Market Challenges and Opportunities

Challenges

- Historical economic dependence on industries like coal mining

- Need for continued economic diversification

- Ongoing discussions about housing affordability

- Limited legislative response to housing market pressures

Opportunities

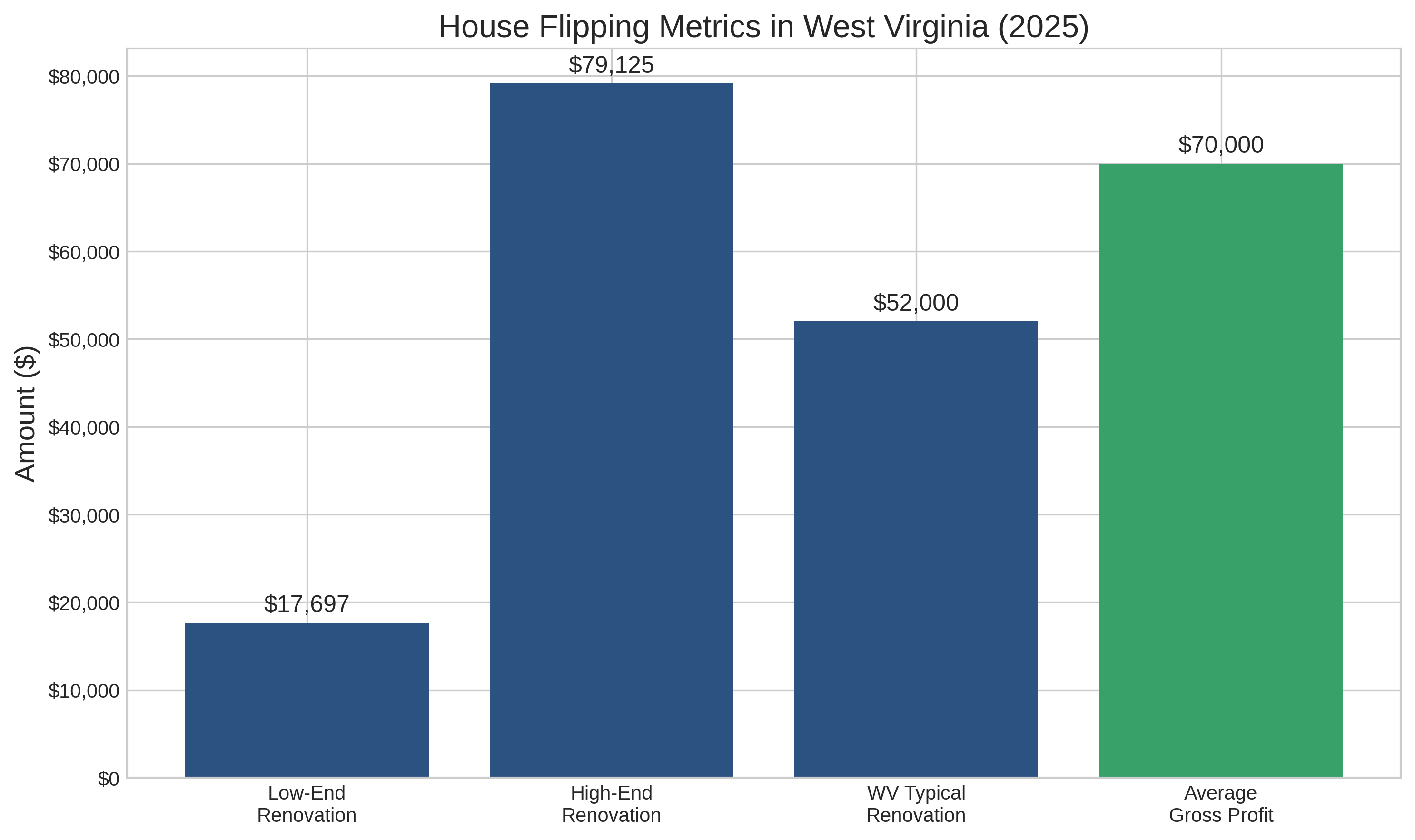

- Affordable entry point for investors compared to national averages

- Lower competition creates potential investment opportunities

- High occupancy rates (e.g., 97.3% in some multifamily units)

- Natural beauty of the state continues to attract potential residents

Investment Potential Indicators

Market Strengths

- Affordable housing market

- Potential for both cash flow and property appreciation

- Growing markets in key cities

- Rental Property Rate: 27.1% of properties are tenant-occupied (compared to 36.2% nationally)

Future Outlook

- Moderate but steady growth expected to continue

- Potential for strategic investments in emerging areas

- Importance of monitoring local infrastructure and development projects

Rental Market Statistics

Rental Market Overview

- Statewide average rent: $915-$1,097 per month

- Tenant-occupied percentage: 27.1% (compared to 36.2% nationally)

- Multifamily occupancy rate: 97.3% in some areas

- Rental property ownership costs average around $781 per month

Top Short-Term Rental Markets

- Dunmore, WV

- Fayetteville, WV

- Berkeley Springs, WV

- Harpers Ferry, WV

- Davis, WV

These locations offer strong potential for vacation rentals and short-term stays, particularly in areas with tourism appeal and outdoor recreation opportunities.

Ready to Develop Your Investment Strategy?

Now that you understand the West Virginia real estate market landscape, it's time to develop a targeted investment strategy. Our business strategy guide provides detailed approaches for different investment models in West Virginia.

Explore Investment Strategies